Resident company with paid-up capital above RM25 million at the beginning of the basis. On first RM500000 chargeable income 17.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

New principal hub companies will enjoy a reduced corporate tax rate.

. The amount from this is based on the total income that companies obtain while having a business activity every. A company is tax resident in Malaysia in a basis year normally the financial year if at any time during the. These companies are taxed at a rate of 24.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Headquarters of Inland Revenue Board Of Malaysia. Malaysia was ranked 12 out of 190.

Income Tax Rate Malaysia 2018 vs 2017. 24 Tax on Royalties. Companies incorporated in Malaysia.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Business losses can be set off against income from all sources in the current year. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

Corporate companies are taxed at the rate of 24. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

Rate TaxRM A. Year Assessment 2017 - 2018. Malaysia Corporate Tax Rate was 24 in 2022.

For little and medium venture SME the main RM500000 Chargeable Income will. The carryback of losses is not permitted. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. The corporate tax rate in Malaysia is collected from companies.

Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income may be reduced. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900. Corporate - Corporate residence.

Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of. Her chargeable income would fall.

Contract payment for services done in Malaysia. On subsequent chargeable income 24. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching.

The proposed sales tax will be 5 and 10 or a specific rate for petroleum. Corporate tax rates for companies resident in Malaysia. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an.

Last reviewed - 14 December 2021. 10 Tax on rental of moveable. Tax Rate of Company.

Not only are the. Interest paid by approved financial institutions. The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia.

Corporate tax rates for companies resident in Malaysia is 24. Jurisdiction 2014 2015 2016 2017 2018 Greece 26 29 retroactively increased from 26 in July 2015 for profits derived in accounting periods commencing as. What is the Corporate Tax Rate in Malaysia.

The current CIT rates are provided in. On the First 5000. Rates of tax 1.

Any unutilised losses can be carried forward for a maximum period of 7. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Special classes of income.

Tax Rate of Company. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie.

There Are Currently Five Bauxite Mines In Australia Providing Feedstock For The Seven Alumina Refineries Which In Turn Supply Alumina Bauxite Export Australia

United Kingdom Food Security Report 2021 Theme 1 Global Food Availability Gov Uk

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Financial Stability Review May 2018

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Pakistan Gdp Growth Rate 2021 Data 2022 Forecast 1952 2020 Historical Chart

The State Of Tax Justice 2021 Eutax

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Costa Coffee Revenue 2010 2018 Statista

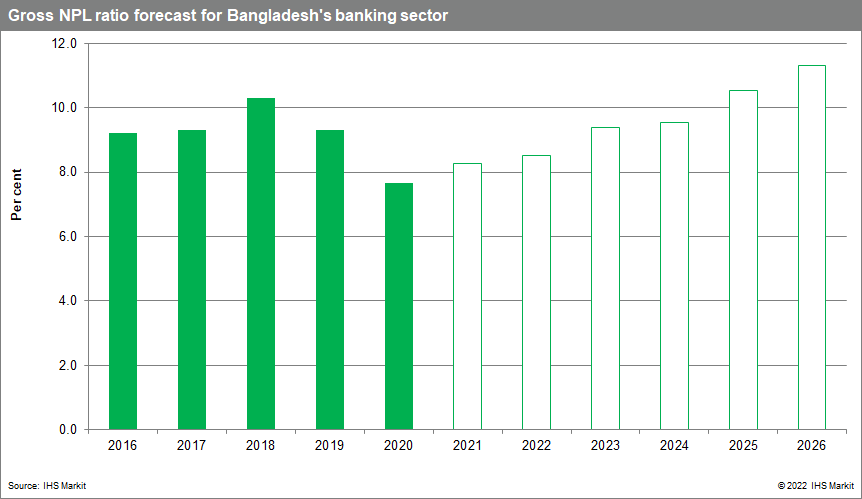

Banking Risk Monthly Outlook February 2022 Ihs Markit

Income Tax Malaysia 2018 Mypf My

Booking Holdings Revenue 2021 Statista

Last Year Icn Turned Out To Be One Of The Best Performing Ipos In Thailand Ipo Radar Icn Nokia Siemens Best Buddy They Are Words Networking Good Buddy

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

2018 Public Holidays In Malaysia School Holiday Programs Tuition Centre School Holidays

Complete List Of Cart Abandonment Rate Statistics 2006 2021

Effect Of The Subsidised Electrical Energy Tariff On The Residential Energy Consumption In Jordan Sciencedirect

Module Price Index Pv Magazine International